Market Entry into North America for a Domestic Daily Chemical Company

Go Global

Client Profile:

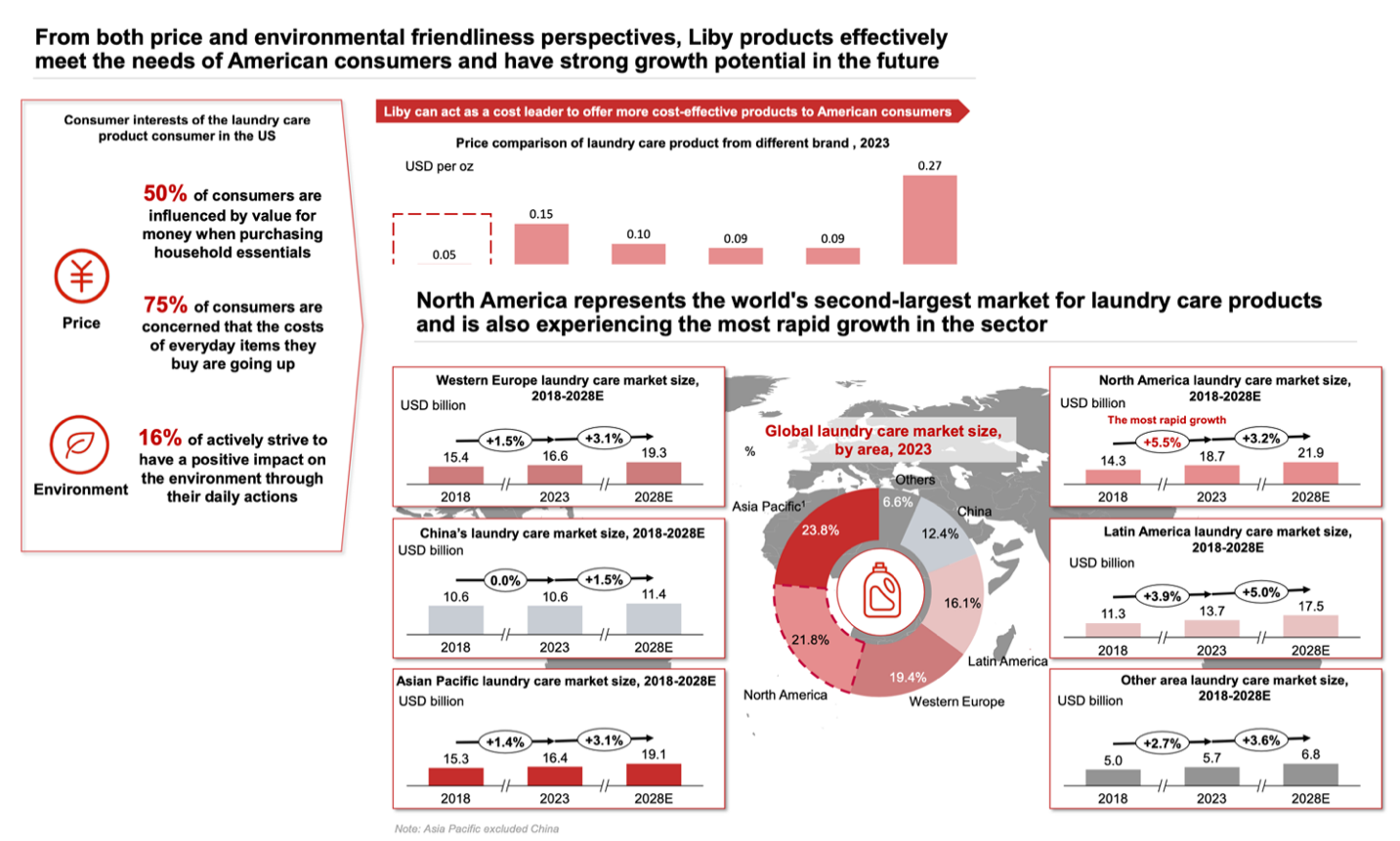

China's leading daily chemical company, with 6 major product lines such as home cleaning, personal care, etc., with a domestic market share of more than 30% and annual sales of more than 5 billion yuan. Due to increasing homogenization competition in China, it is in urgent need to develop the second growth curve.

Core Claims:

Rapidly enter the mainstream retail channels in North America.

Build brand awareness and avoid the label of "low-cost OEM".

Optimize the product portfolio by accurately matching the needs of North American consumers.

Execution Challenges

1. High channel barriers

The average entry cycle for new brands in mainstream channels such as Walmart takes 9-12 months.

Admission fee for large-scale supermarkets and KA channels exceeds $500,000 per product.

Local brands occupy more than 80% of the shelf resources.

2. Significant differences in consumption

North American Consumers Prefer Concentrated, Eco-Certified Products.

Chinese supermarkets' unit price is only 60% of that of local supermarkets.

3. Compliance Costs Surge

EPA certification cycle time up to 6-8 months.

California's Proposition 65 Increases Costs of Packaging Retrofits.

Customized solutions:

Precise market entry

Focus on Southwest Chinese neighborhoods (California/Texas) to build model markets.

Adopting the dual-track system of "local supermarkets+ Chinese supermarkets" for distribution.

Phased implementation

Phase I (3 months): Access to 38 Chinese supermarkets through local distributors.

Phase 2 (6 months): Target base category access completed, first 12 stores on shelves.

Phase 3: Optimize SKU mix based on sales data.

Established 82 points of sale covering the east and west coasts in 12 months. The average monthly sales rate grew from 58% to 72% in the first month, an increase of 14%; the product unit price grew from $9.5 to an average of $11.2, an increase of 18%. The company not only saves hundreds of thousands of dollars in channel costs, but also increases the brand's premium ability through precise customer targeting.

Best Practice

National Retail Channel Sales Potential Insight Study for a Consumer Goods Brand

Loya continuously tracks multi-month sales data from over 3,000 retail outlets across 28 provinces/municipalities and 9 major channels nationwide for clients, gaining precise insights into cross-category offline consumption trends (with specialized focus on the dairy sector) and competitive landscapes. Our analyses decode the overarching trajectory of retail markets, revealing core dynamics including foot traffic fluctuations and purchasing power shifts, while emphasizing the strategic prominence of key categories like dairy in store-level sales performance. Delivering multi-dimensional monitoring outcomes, we equip clients with mission-critical market intelligence on industry landscapes, evolving consumption patterns, and competitor postures – empowering data-driven retail strategy optimization and category governance.

View

Lean Test for Tea Brand

Reduce costs by 35% and boost sales for a branded tea drink. To optimize flavor and packaging preferences, we conducted consumer behavior studies, taste tests, and packaging trials. This streamlined approach cut time-to-market by 3 months and delivered 12% higher initial sales than projected.

View

Display Optimization for a Liquid Milk Brand in Hypermarket

We conducted display optimization research for a dairy brand through testing the layout of designated product categories and evaluating the effectiveness of various display combinations, providing recommendations for main shelf arrangements and SKU layout for our client to develop more effective shelf display strategies.

View

In-Store Verification for a Snack Food Brand

A well-established domestic snack food brand has continuously entrusted us with high-frequency monitoring of retail channels across the national market for years, involving both direct supply channels (e.g. basic displays and promotional displays) and non-direct supply channels. We employ a strict O2O (Online-to-Offline) data collection methodology and delivered comprehensive data reports including monthly store-level data, monthly category data, and other relevant reports.

View

Research on Demand for Smart Kitchen Appliances Regeneration

We assisted a smart home appliances brand to gain deep insights into the pain points and unmet needs of both current and potential users during the product iteration and innovation process, focusing on the mid-to-high-end integrated kitchen appliance market and adopting an innovative research methodology combining video observation, in-home immersive studies, and co-creation for the sake of comprehensive and precise user insights.

View

Ask a question

Want to know how we can help your business grow? Contact us!

Loya International Marketing Research Co., Ltd.

Tel:+86 (0)20-38361007

David|13533653828|David@dgchina.com

Location: Guangzhou, China

We want to hear from you

If you have any questions, please leave us a message!